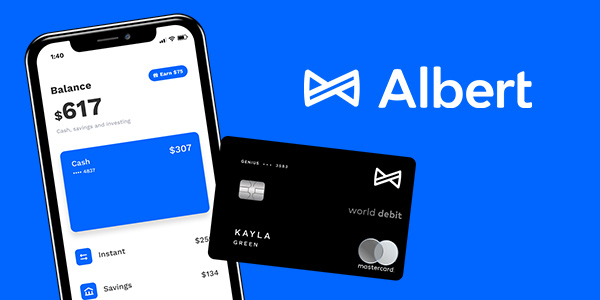

When it comes to managing your finances, finding the right credit card can make all the difference. But with so many options available, how do you choose? That’s where the Albert Cash Card comes in.

The Albert Cash Card is a real credit card that offers a range of benefits and features to help you make the most of your money. From cash-back rewards to early direct deposits, it’s designed to make banking more convenient and rewarding.

But is the Albert Cash Card legit? In this Albert Cash Card review 2024, we’ll dive into its benefits, features, eligibility requirements, and application process to give you a comprehensive overview of what this card has to offer.

Key Takeaways:

- The Albert Cash Card has an overall rating of 4 out of 5.

- It offers cash-back rewards, early direct deposits, and savings tools.

- There is no minimum deposit requirement to open an account.

- The Albert Cash Card is FDIC insured through its partner institution, Sutton Bank.

- It does not offer joint bank accounts and has a monthly fee for the optional Genius subscription.

Albert Cash Card Benefits

The Albert Cash Card offers several benefits that make it a convenient and valuable financial tool for users:

No Minimum Deposits

Unlike traditional bank accounts that require a minimum deposit to open, the Albert Cash Card allows users to open an account without the need for a specific amount of money. This makes it accessible for individuals of all financial backgrounds.

Early Direct Deposit

The early direct deposit feature of the Albert Cash Card allows users to access their paycheck up to two days early. This can be especially beneficial for individuals who need immediate access to their funds.

Cash-Back Rewards

Using the Albert Cash Card for purchases with select merchants can earn users cash-back rewards. By taking advantage of this feature, users can save money and get rewarded for their everyday spending.

Automatic Savings Tools

The Albert Cash Card offers automatic savings tools that help users effortlessly save money. By regularly transferring funds from their linked checking account into savings, users can build their savings effortlessly over time.

Overall, the Albert Cash Card’s benefits make it a flexible and useful financial tool for users. Whether you’re looking for a convenient way to manage your money, access your paycheck early, earn rewards, or save effortlessly, the Albert Cash Card has you covered.

| Benefits | Details |

|---|---|

| No Minimum Deposits | Users can open an account without the need for a specific amount of money. |

| Early Direct Deposit | Access your paycheck up to two days early. |

| Cash-Back Rewards | Earn cash-back rewards by using the card with select merchants. |

| Automatic Savings Tools | Save money effortlessly by regularly transferring funds from your checking account into savings. |

Albert Cash Card Features

The Albert Cash Card offers a variety of powerful features that enhance its usability and value for users. Here are some key features:

1. Access to Over 55,000 Free ATMs

The Albert Cash Card provides users with convenient access to a network of over 55,000 free ATMs nationwide. This extensive ATM network ensures that users can withdraw cash without incurring any additional fees or surcharges.

2. Simple and Flexible Ways to Deposit Cash

With the Albert Cash Card, users have multiple options to deposit cash into their account. They can conveniently deposit cash through direct deposit, mobile check deposit, or transfer funds from other bank accounts. This flexibility makes it easy for users to manage their financial transactions effectively.

3. Cash-Back Rewards Activation

The Albert Cash Card allows users to activate cash-back rewards with one merchant at a time through its mobile app. By selecting a participating merchant, users can earn cash-back rewards on eligible purchases, providing them with additional value and savings.

4. Competitive Interest Rates on Savings

In addition to its cash management features, the Albert Cash Card also offers a savings account with a competitive interest rate. Users can save and grow their funds with the convenience of their Albert Cash Card account, maximizing their financial potential.

5. Customized Savings Goals

The Albert Cash Card enables users to set customized savings goals. By defining specific objectives, users can track their progress and stay focused on achieving their financial targets. This feature promotes responsible financial management and helps users maintain a disciplined approach to saving.

“With its wide range of features, the Albert Cash Card empowers users with a comprehensive suite of tools to manage their finances conveniently and intelligently.”

| Features | Benefits |

|---|---|

| Access to over 55,000 free ATMs | Convenient cash withdrawals without fees |

| Flexible cash deposit options | Convenient ways to add funds to the account |

| Cash-back rewards activation | Earning rewards on eligible purchases |

| Competitive interest rates on savings | Grow savings with a high-interest savings account |

| Customized savings goals | Track progress and achieve financial targets |

Albert Cash Card Eligibility

The Albert Cash Card is available to individuals who meet certain eligibility criteria. To apply for an Albert Cash Card, applicants generally need to meet the following requirements:

- Be at least 18 years old

- Have a valid Social Security number

- Have a valid U.S. mailing address

The application process typically involves providing personal information, such as name, address, and Social Security number. Additionally, applicants may be required to verify their identity by providing a government-issued ID. The approval process is subject to verification and review.

| Eligibility Requirements | |

|---|---|

| Minimum Age | 18 years old |

| Social Security Number | Valid SSN required |

| Mailing Address | Valid U.S. mailing address required |

Conclusion

In conclusion, the Albert Cash Card is a legitimate credit card option that offers a range of features and benefits for individuals seeking a convenient online banking platform. With cash-back rewards, early direct deposits, and automatic savings tools, it provides users with the opportunity to manage their finances effectively and save money.

While there is a monthly fee for the optional Genius subscription and joint bank accounts are not available, the Albert Cash Card compensates for these limitations with access to a vast network of free ATMs and competitive interest rates on its savings account. It also boasts the security of being FDIC through its partner institution, Sutton Bank.

For those in search of a real credit card that meets their financial needs, the Albert Cash Card Review 2024 proves that it is a reliable option. Whether it’s earning cash-back rewards, getting early access to direct deposits, or utilizing automatic savings tools, the Albert Cash Card offers valuable benefits that can enhance financial management and savings strategies.

FAQ

Is the Albert Cash Card a real credit card?

Yes, the Albert Cash Card is a real credit card that offers a range of features and benefits.

What are the benefits of the Albert Cash Card?

The Albert Cash Card offers benefits such as no minimum deposits, early direct deposit, cash-back rewards, and automatic savings tools.

What features does the Albert Cash Card have?

The Albert Cash Card features access to over 55,000 free ATMs, the ability to deposit cash via direct deposit, mobile check deposit, or transfers from other bank accounts, and the option to activate cash-back rewards with one merchant at a time through the mobile app.

Who is eligible for the Albert Cash Card?

The Albert Cash Card is available to individuals who meet certain eligibility criteria, including being at least 18 years old, having a valid Social Security number, and having a valid U.S. mailing address.

What is the application process for the Albert Cash Card?

The application process typically involves providing personal information, such as name, address, and Social Security number, and verifying identity through a government-issued ID.

Is the Albert Cash Card FDIC insured?

Yes, the Albert Cash Card is FDIC insured through its partner institution, Sutton Bank.