Did you know that options trading is becoming increasingly popular among UK investors? In fact, according to recent statistics, the options trading market in the UK is expected to reach a staggering value of $4.8 billion by 2024. This highlights the significant growth and potential opportunities that options trading can offer to UK investors looking to diversify their investment portfolios.

With the rising demand for options trading platforms, it’s essential for UK investors to choose the right platform that suits their specific needs and goals. To help you navigate through the vast options available, UK.StockBrokers.com has conducted an in-depth review of 17 brokerages to identify the best options trading platforms for UK investors in 2024.

Key Takeaways:

- The options trading market in the UK is projected to reach $4.8 billion by 2024.

- UK.StockBrokers.com has reviewed 17 brokerages to identify the best options trading platforms for UK investors.

- Choosing the right options trading platform is crucial for maximizing trading potential and achieving investment goals.

- Options trading offers UK investors the opportunity to diversify their portfolios and optimize their returns.

- Stay tuned to discover the top options trading platforms that can help you achieve your financial goals in 2024.

Best UK Trading Platforms for Active Traders

When it comes to active trading, having access to the best trading platforms is essential for UK investors. These platforms offer a range of features and tools designed to support active traders in their strategies and goals. Here are the top UK trading platforms that cater to active traders:

1. Interactive Brokers

Interactive Brokers is the top choice for active traders in the UK. With its wide variety of trading tools and resources, active traders can make informed decisions and execute trades efficiently. The platform provides real-time market data, advanced order types, and customizable trading interfaces. Furthermore, Interactive Brokers offers competitive pricing, making it a favored platform for active traders.

2. Saxo

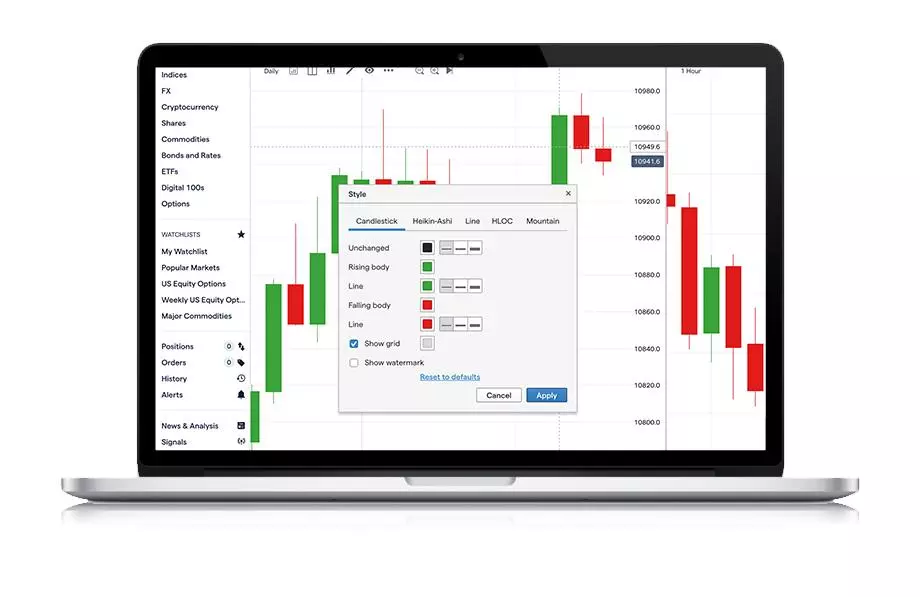

Saxo is renowned for its robust platform suite, making it a preferred choice among active traders. The platform provides a comprehensive range of trading tools and resources, including advanced charting, technical analysis, and risk management tools. Additionally, Saxo has an insightful research team that delivers market insights and analysis to aid active traders in making informed trading decisions.

3. IG

IG is another excellent option for active share dealing in the UK. The platform offers a user-friendly interface, making it easy for active traders to navigate and execute trades. IG provides powerful research tools, including real-time news, market analysis, and economic calendars. Active traders can also access a wide range of markets and trading instruments, allowing for diversification and flexibility in their trading strategies.

4. eToro

eToro is a popular trading platform known for its social trading features. Active traders can learn and interact with other traders, as well as copy their trades. The platform also offers a wide range of trading instruments, including stocks, cryptocurrencies, and indices. With eToro’s intuitive interface and innovative tools, active traders can stay on top of market trends and make well-informed trading decisions.

5. Trading 212

Trading 212 is an all-in-one trading platform that caters to active traders. The platform offers commission-free trading, making it cost-effective for frequent traders. Trading 212 provides advanced charting tools, technical indicators, and real-time news updates. Additionally, the platform offers a wide range of investment instruments, including stocks, ETFs, and cryptocurrencies, allowing active traders to diversify their portfolios.

6. XTB

XTB is another notable platform for active traders in the UK. The platform offers a user-friendly interface and a wide range of trading tools. XTB provides access to various markets, including forex, stocks, indices, and commodities. Active traders can benefit from low spreads, fast execution, and powerful trading tools, ensuring they have the necessary resources to succeed in their trading activities.

With these top UK trading platforms, active traders can access a wealth of resources and tools to support their trading strategies. Whether it’s real-time market data, advanced charting, or social trading features, these platforms cater to the needs of active traders and provide them with the competitive edge they need to succeed in the dynamic financial markets.

| Platform | Features | Commission |

|---|---|---|

| Interactive Brokers | Wide variety of trading tools and resources | Competitive pricing |

| Saxo | Robust platform suite and insightful research team | Varies |

| IG | User-friendly platform and powerful research tools | Varies |

| eToro | Social trading features and wide range of instruments | Varies |

| Trading 212 | Commission-free trading and advanced charting tools | Commission-free |

| XTB | User-friendly interface and low spreads | Varies |

Choosing the Right Share Dealing Platform

When it comes to selecting a share dealing platform, making an informed decision is crucial for your investment success. There are several factors to consider before choosing the right platform that aligns with your trading goals and preferences.

Regulation and Security

First and foremost, ensure that the share dealing platform you consider is properly regulated. This helps reduce the risk of scams and provides a level of security for your investments. Look for platforms regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK.

Investment Choices and Trading Platforms

Compare the investment choices offered by different platforms. Some platforms may provide a wider range of stocks, bonds, ETFs, and other financial instruments, allowing you to diversify your portfolio effectively. Additionally, assess the available trading platforms and their user-friendliness. Look for platforms that provide intuitive interfaces and advanced trading tools to enhance your trading experience.

Trading Tools for Active Traders

For active traders, the availability of trading tools is crucial. These tools can include real-time market data, advanced technical analysis tools, customizable charts, and more. The right set of tools can significantly impact your trading strategies and enhance your decision-making process.

Trading Costs: Fees and Commissions

Consider the trading costs associated with different platforms. This includes fees and commissions charged for executing trades and managing your investments. Take into account factors such as account maintenance fees, transaction fees, and any additional charges. Compare the costs among different platforms to find the most suitable option for your trading needs and budget.

By carefully evaluating these factors, you can make a well-informed decision when choosing the right share dealing platform. Remember that your trading success depends not only on your strategy but also on the reliability and functionality of the platform you choose.

“Choosing the right share dealing platform is a vital part of your investment journey. Take your time, do your research, and consider your specific needs to find the platform that empowers you to achieve your financial goals.” – [Author Name]

Comparison of Share Dealing Platforms

| Platform | Regulation | Investment Choices | Trading Tools | Trading Costs |

|---|---|---|---|---|

| Platform A | FCA | Wide range | Advanced | Competitive fees |

| Platform B | FCA | Limited | Basic | High fees |

| Platform C | FCA | Medium range | Advanced | Low fees |

| Platform D | FCA | Wide range | Basic | Competitive fees |

Comparison of different share dealing platforms based on regulation, investment choices, trading tools, and trading costs.

Illustrative image highlighting the importance of choosing the right share dealing platform.

How to Buy Stocks Online with a Broker

To buy stocks online with a broker, follow these steps:

- Open an online brokerage account and provide necessary personal information.

- Fund your account by depositing funds via bank transfer or linking your bank account.

- Familiarize yourself with the platform and its features.

- Conduct research and select the stocks you’re interested in.

- Place an order online, specifying the stock symbol, number of shares, and order type.

- Monitor your stock investments and stay informed about market developments.

Overview of Top Options Brokers in the UK

When it comes to options trading in the UK, there are several top brokers that offer a range of features and services to cater to the needs of investors. Here is an overview of some of the leading options brokers in the UK:

1. Plus500

Plus500 is a highly popular options broker known for its attractive features, including no commissions and tight spreads. With a user-friendly platform and a wide range of tradable options, Plus500 is a preferred choice for many UK investors.

2. AvaTrade

AvaTrade is another top options broker that offers various platforms and tools to enhance the trading experience. While it provides a comprehensive range of options trading services, it does have limitations when it comes to buying stocks. Nevertheless, AvaTrade remains a reliable choice for traders looking for diverse options.

3. IG

IG is renowned for its robust options trading platform that offers advanced features and powerful research tools. With a user-friendly interface and a wide range of options markets, IG caters to both experienced and novice options traders in the UK.

4. XTB

XTB is a regulated options broker that stands out for its low forex fees. It offers a range of options trading instruments and provides a platform that is suitable for both beginners and experienced traders.

5. Saxo Bank

Saxo Bank is a well-established options broker that provides a wide range of trading instruments, including options. With a reputation for reliability and expertise, Saxo Bank offers a comprehensive platform for options trading in the UK.

6. IQcent.com

IQcent.com is a binary options trading platform that focuses on providing a user-friendly interface and innovative features like copy trading. It appeals to traders looking for simplicity and access to various binary options markets.

Each of these options brokers caters to different trading preferences and strategies. It is important to carefully evaluate the features, fees, and trading tools offered by each broker to find the one that aligns with your investment goals and trading style.

| Broker | Features |

|---|---|

| Plus500 | No commissions, tight spreads |

| AvaTrade | Multiple platforms, limited stock buying |

| IG | Robust platform, advanced features |

| XTB | Regulated, low forex fees |

| Saxo Bank | Wide range of trading instruments |

| IQcent.com | User-friendly interface, binary options trading |

Conclusion

In conclusion, choosing the best options trading platform in the UK depends on individual preferences and trading strategies. Active traders should consider factors such as platform features, research tools, and fees before making a decision.

The reviewed platforms, including Interactive Brokers, Saxo, IG, Plus500, AvaTrade, XTB, and IQcent.com, provide options for UK investors to maximize their trading potential in 2024.

It is crucial to conduct thorough research and consider personal trading needs when selecting a platform.

FAQ

What are the best options trading platforms for UK investors in 2024?

The best options trading platforms for UK investors in 2024 include Interactive Brokers, Saxo, IG, Plus500, AvaTrade, XTB, and IQcent.com.

What features do these platforms offer for active traders?

These platforms offer a wide variety of trading tools and resources, user-friendly interfaces, advanced features, and a range of trading instruments to support active traders’ needs.

What factors should I consider when choosing a share dealing platform in the UK?

When choosing a share dealing platform in the UK, consider factors such as proper regulation, investment choices, available trading platforms, trading tools, and trading costs including fees and commissions.

How can I buy stocks online with a broker?

To buy stocks online with a broker, follow these steps: open an online brokerage account, fund your account, familiarize yourself with the platform, conduct research, place an order online, and monitor your stock investments.

Which options brokers offer no commissions and tight spreads?

Plus500 is a popular options broker that offers no commissions and tight spreads.

Are there any limitations on buying stocks with AvaTrade?

Yes, AvaTrade provides a range of platforms and tools but has limitations on buying stocks.

What makes IG a good options trading platform?

IG offers a robust options trading platform with advanced features and powerful research tools.

What are the standout features of XTB as an options broker?

XTB is a regulated options broker that offers low forex fees.

What does Saxo Bank offer as an options broker?

Saxo Bank provides a wide range of trading instruments in addition to its robust platform suite and insightful research team.

What features does IQcent.com offer for binary options trading?

IQcent.com focuses on binary options trading, offering a user-friendly interface and a copy trading feature.