Did you know that making $35 an hour can lead to an annual salary of $72,800? That’s right! If you earn $35 per hour, your yearly income can reach impressive heights. But how exactly is this calculation made? Let’s dive into the details and explore how your hourly rate can translate into a substantial yearly salary.

Key Takeaways

- Earning $35 an hour can result in a yearly salary of $72,800.

- Your annual income is calculated by multiplying your hourly rate by the number of hours you work per week, weeks per year, and months per year.

- There are various factors, such as taxes and deductions, that can affect your final take-home pay.

- Converting hourly pay to annual salary provides insight into the potential earning power of an hourly wage.

- It’s important to consider the number of hours you work and any additional benefits or deductions when assessing your overall income.

How to Calculate Hourly Wage to Yearly Income

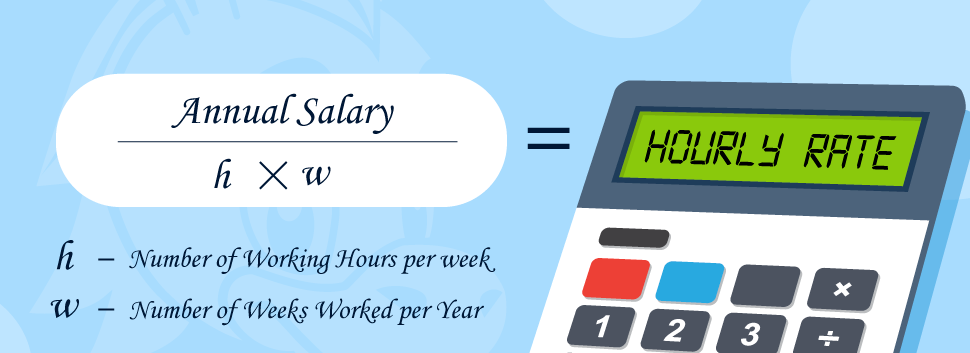

To calculate your hourly wage to yearly income, you need to consider a few factors such as your hourly rate, the number of hours you work per week, the number of weeks in a year, and the number of months in a year.

Let’s take an example using an hourly rate of $35:

Hourly Rate: $35

Hours Worked Per Week: 40

Weeks in a Year: 52

Months in a Year: 12

To calculate your yearly income, multiply your hourly rate ($35) by the number of hours worked per week (40), the number of weeks in a year (52), and the number of months in a year (12). Following this formula:

Yearly Income = Hourly Rate x Hours Worked Per Week x Weeks in a Year x Months in a Year

Yearly Income = $35 x 40 x 52 x 12

Yearly Income = $72,800

So, if you make $35 an hour and work 40 hours per week, your yearly salary would be $72,800.

Calculating your hourly wage to yearly income is a helpful way to understand the bigger picture of your earnings. It allows you to better plan your finances and make informed decisions about your budget and financial goals.

Monthly Salary Calculation for $35 an Hour

If you make $35 an hour, your monthly salary would be $6,066.67. This calculation is based on your hourly rate ($35), the number of hours you work per week (40), the number of weeks per year (52), and the number of months per year (12).

When considering your hourly pay of $35, it’s essential to understand its monthly implications. By multiplying your hourly wage by the number of hours worked per week, weeks per year, and months per year, we arrive at a monthly salary of $6,066.67.

This estimation highlights the potential earning power of a $35 hourly rate. However, keep in mind that actual monthly salaries may vary based on factors such as taxes and deductions.

Now that we’ve explored the monthly salary calculation, let’s dive deeper into other salary breakdowns in the sections below.

Weekly Salary Calculation for $35 an Hour

If you make $35 an hour, your weekly salary would be $1,400. This calculation is based on your hourly rate ($35), the number of hours you work per week (40), and the number of weeks per year (52).

Here is a breakdown of the calculation:

| Hourly Rate | Number of Hours per Week | Number of Weeks per Year | Weekly Salary |

|---|---|---|---|

| $35 | 40 | 52 | $1,400 |

As shown in the table above, the weekly salary for someone earning $35 an hour and working 40 hours per week would amount to $1,400. This calculation is crucial for understanding your income on a weekly basis and managing your finances accordingly.

Daily Salary Calculation for $35 an Hour

If you make $35 an hour, your daily salary would be $280. This calculation is based on your hourly rate ($35) and the number of hours you work per day (8).

Calculating your daily salary can provide a clearer understanding of your earnings and help you plan your finances effectively. Knowing how much you make per day can be beneficial for budgeting, setting financial goals, and making informed financial decisions.

By multiplying your hourly rate of $35 by the number of hours you work per day, which is typically 8 hours, you can determine your daily salary. In this case, it would amount to $280.

It’s important to note that this calculation assumes you work 8 hours a day consistently. If your working hours vary, you can adjust the calculation accordingly. Additionally, factors such as overtime, breaks, and deductions may affect your actual daily earnings.

Understanding your daily salary provides valuable insight into your overall income and can help you evaluate your financial progress. By tracking your daily earnings, you can make informed decisions about your expenses, savings, and investments.

How to Convert Hourly Pay to Annual Salary

To convert hourly pay to annual salary, you’ll need to consider the number of hours you work per week, the number of weeks in a year, and the number of months in a year.

Here’s how you can calculate your annual salary based on your current hourly wage:

- Multiply your hourly rate by the number of hours you work per week.

- Multiply the result by the number of weeks in a year.

- Finally, multiply the result by the number of months in a year.

This formula will help you estimate your annual income based on your current hourly pay. Let’s take a look at an example:

Suppose you earn $20 per hour and work 40 hours per week:

| Hourly Rate | Number of Hours per Week | Number of Weeks per Year | Number of Months per Year | Annual Salary |

|---|---|---|---|---|

| $20 | 40 | 52 | 12 | $41,600 |

Based on this calculation, your annual salary would be $41,600. However, please keep in mind that this is an estimation and may not reflect the actual deductions or benefits associated with your job.

Now you can use this method to convert your hourly pay to an annual salary and gain a better understanding of your income.

FICA Withholding and Other Deductions

In addition to income tax withholding, your paycheck also includes deductions for FICA taxes. FICA stands for the Federal Insurance Contributions Act and includes contributions to the Social Security and Medicare programs. These contributions are shared between the employee and the employer.

Contributions to Social Security are divided between the Old-Age, Survivors, and Disability Insurance (OASDI) program and the Medicare program. The OASDI program provides retirement and disability benefits, while the Medicare program offers healthcare coverage for individuals aged 65 and older, as well as certain disabled individuals.

The FICA tax rates are currently as follows:

| FICA Tax | Employee Rate | Employer Rate | Total Rate |

|---|---|---|---|

| Social Security (OASDI) | 6.2% | 6.2% | 12.4% |

| Medicare (HI) | 1.45% | 1.45% | 2.9% |

It’s important to note that there is a wage base limit for Social Security contributions. For 2021, this limit is $142,800. Any earnings above this limit are not subject to Social Security tax.

In addition to FICA withholding, your paycheck may also include deductions for health insurance coverage and retirement contributions. These deductions can vary depending on your employer and benefit plans.

Health Insurance Deductions

Health insurance deductions are common in many workplaces and help cover the cost of medical, dental, and vision insurance. The amount deducted from your paycheck may differ depending on the type of coverage you have and the specific plan.

Retirement Contributions

Retirement contributions are another type of paycheck deduction that helps you save for the future. Many employers offer retirement plans such as 401(k) or 403(b), which allow you to contribute a portion of your salary to a tax-advantaged retirement account. The amount you contribute is deducted from your paycheck before taxes.

It’s important to review your paycheck stub regularly to ensure that the deductions accurately reflect your benefits and contributions. Understanding these deductions allows you to better plan your finances and make informed decisions about your salary and benefits.

| Paycheck Deductions | Description |

|---|---|

| Income Tax Withholding | Deduction for federal, state, and local income taxes. |

| FICA Taxes | Deduction for Social Security and Medicare contributions. |

| Health Insurance | Deduction for medical, dental, and vision insurance coverage. |

| Retirement Contributions | Deduction for contributions to a retirement savings plan. |

If you liked this article, be sure to also check out our article about: Albert Cash Card Review

Conclusion

In conclusion, if you make $35 an hour, your yearly salary would amount to $72,800. This estimation is based on a 40-hour workweek and takes into consideration the number of weeks and months in a year. However, it is essential to bear in mind that this figure is subject to variation due to factors like taxes and deductions.

Understanding the breakdown of your hourly wage into yearly income can provide valuable insights into your financial planning. By calculating your annual salary, you can take a comprehensive view of your earning potential and make informed decisions regarding budgeting, savings, and expenses.

Although the calculation is straightforward, it is crucial to determine the accuracy of the estimation by consulting with a financial advisor or accounting professional. Additionally, it is essential to stay informed about any changes in tax laws or employment regulations that may impact your actual income.

FAQ

An Hour Is How Much A Year?

If you make an hour, your yearly salary would be ,800. This calculation is based on a 40-hour workweek and takes into consideration the number of weeks and months in a year.

How to Calculate Hourly Wage to Yearly Income?

To calculate your hourly wage to yearly income, multiply your hourly rate by the number of hours you work per week, the number of weeks per year, and the number of months per year.

How to Convert Hourly Pay to Yearly Earnings?

To convert hourly pay to yearly earnings, multiply your hourly rate by the number of hours you work per week, the number of weeks per year, and the number of months per year.

What’s the Formula for Hourly Wage to Yearly Income?

The formula for converting hourly wage to yearly income is: Hourly Rate x Hours Per Week x Weeks Per Year x Months Per Year.

What’s the Hourly Wage to Annual Salary Conversion?

The hourly wage to annual salary conversion can be calculated by multiplying the hourly rate by the number of hours worked per week, the number of weeks per year, and the number of months per year.

How Much is An Hour Monthly?

If you make an hour, your monthly salary would be ,066.67. This calculation is based on a 40-hour workweek and takes into consideration the number of weeks and months in a year.

How Much is An Hour Weekly?

If you make an hour, your weekly salary would be

FAQ

$35 An Hour Is How Much A Year?

If you make $35 an hour, your yearly salary would be $72,800. This calculation is based on a 40-hour workweek and takes into consideration the number of weeks and months in a year.

How to Calculate Hourly Wage to Yearly Income?

To calculate your hourly wage to yearly income, multiply your hourly rate by the number of hours you work per week, the number of weeks per year, and the number of months per year.

How to Convert Hourly Pay to Yearly Earnings?

To convert hourly pay to yearly earnings, multiply your hourly rate by the number of hours you work per week, the number of weeks per year, and the number of months per year.

What’s the Formula for Hourly Wage to Yearly Income?

The formula for converting hourly wage to yearly income is: Hourly Rate x Hours Per Week x Weeks Per Year x Months Per Year.

What’s the Hourly Wage to Annual Salary Conversion?

The hourly wage to annual salary conversion can be calculated by multiplying the hourly rate by the number of hours worked per week, the number of weeks per year, and the number of months per year.

How Much is $35 An Hour Monthly?

If you make $35 an hour, your monthly salary would be $6,066.67. This calculation is based on a 40-hour workweek and takes into consideration the number of weeks and months in a year.

How Much is $35 An Hour Weekly?

If you make $35 an hour, your weekly salary would be $1,400. This calculation is based on a 40-hour workweek and the number of weeks in a year.

How Much is $35 An Hour Daily?

If you make $35 an hour, your daily salary would be $280. This calculation is based on an 8-hour workday.

What are FICA Withholding and Other Deductions?

In addition to income tax withholding, your paycheck also includes deductions for FICA taxes. FICA stands for the Federal Insurance Contributions Act and includes contributions to the Social Security and Medicare programs. These contributions are shared between the employee and the employer. Additionally, your paycheck may also include deductions for health insurance coverage and retirement contributions.

,400. This calculation is based on a 40-hour workweek and the number of weeks in a year.

How Much is An Hour Daily?

If you make an hour, your daily salary would be 0. This calculation is based on an 8-hour workday.

What are FICA Withholding and Other Deductions?

In addition to income tax withholding, your paycheck also includes deductions for FICA taxes. FICA stands for the Federal Insurance Contributions Act and includes contributions to the Social Security and Medicare programs. These contributions are shared between the employee and the employer. Additionally, your paycheck may also include deductions for health insurance coverage and retirement contributions.