Did you know that the average American spends over $1,000 on Christmas gifts alone? It’s no secret that the holiday season can put a strain on your wallet. That’s why we’ve created the Christmas Money Saving Chart: Free Printable to help you stay on top of your holiday budget.

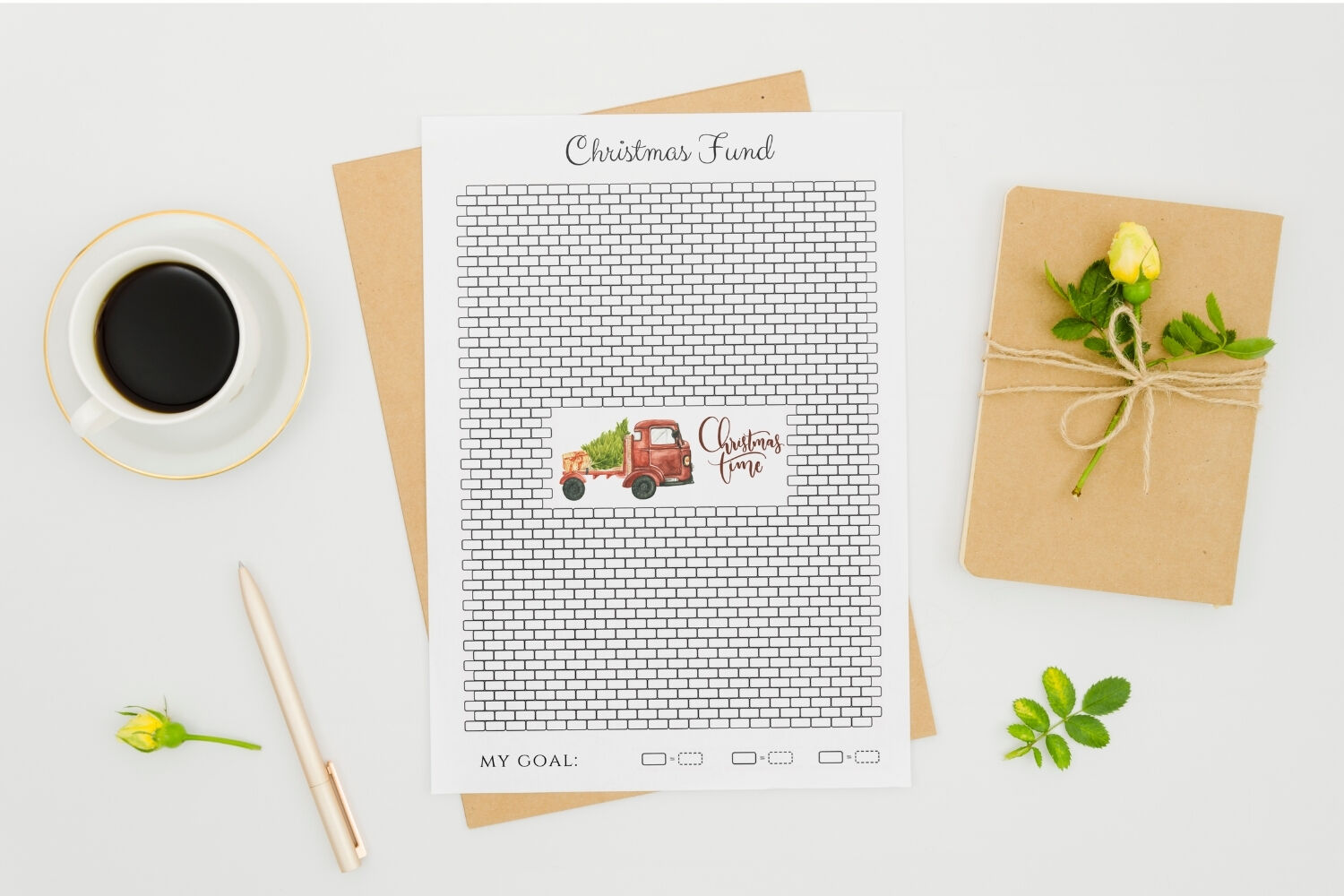

This cute Christmas savings tracker will guide you through the process of saving $300 for the holidays. Whether you choose to use envelopes and cash or a separate bank account, this printable chart will make saving money a fun and interactive activity for the whole family.

Key Takeaways:

- Download our Christmas Money Saving Chart: Free Printable to track your holiday savings.

- This printable guide will help you save $300 for your Christmas expenses.

- Involve the whole family in the savings journey and make it a fun activity.

- Use the chart as a visual representation of your progress and stay motivated.

- Start planning and budgeting early to avoid financial stress during the holiday season.

How to Use the Christmas Savings Tracker

Using the Christmas savings chart is simple. First, decide on the amount you want to save per day. Then, either transfer that amount into a separate account or put the cash into an envelope. Each time you save, color in the corresponding amount on the chart. By the end of your savings journey, you’ll have reached your designated savings goal. This tracker provides a visual representation of your progress and helps you celebrate your success and perseverance.

Tracking Your Savings Made Easy

The Christmas savings tracker is designed to make your savings challenge effortless and enjoyable. Whether you prefer digital or physical tracking, this chart accommodates your preferences. You can use it to monitor your daily progress and stay motivated towards achieving your savings goal.

| Steps to Use the Christmas Savings Tracker: |

|---|

| 1. Decide on your savings goal for the Christmas season. |

| 2. Determine the daily amount you want to save. |

| 3. Transfer the designated saving amount into a separate account or place it in an envelope. |

| 4. Color in the corresponding amount on the Christmas savings chart. |

| 5. Repeat the process daily, coloring in your progress as you save. |

| 6. Celebrate your achievements as you reach your savings goal. |

By implementing this straightforward process, you can stay on track with your savings goal and conquer any budget challenge.

Benefits of a Christmas Savings Tracker

A Christmas savings tracker offers several benefits for your holiday budgeting. It provides a tangible way to track your savings progress and stay motivated. By involving the whole family, it becomes a fun and interactive activity. The printable format allows you to easily print multiple copies and customize them to fit your needs. It also serves as a reminder to be mindful of your spending during the holiday season and encourages financial planning for Christmas.

With a DIY Money Saving Chart, you have a visual representation of your savings journey. Watching the presents on the chart get colored in as you reach your savings goals can be incredibly rewarding and motivating. It gives you a sense of accomplishment and helps you stay on track towards your desired financial target.

Financial planning is crucial for a stress-free holiday season. The Printable Budget Worksheet of a Christmas savings tracker allows you to set clear goals and keep your spending in check. By budgeting your expenses, you can make informed decisions about the gifts you purchase, the decorations you invest in, and the overall holiday experience you aim for. It ensures that you’re planning well in advance and making conscious choices that align with your financial capabilities.

Additionally, involving the whole family in the savings journey makes it an enjoyable experience for everyone. You can turn it into a friendly competition, where each family member contributes to the savings and keeps track of their progress. It not only instills financial discipline in children but also fosters teamwork and a sense of shared responsibility.

Furthermore, the flexibility of a printable chart allows you to print multiple copies for different purposes. For example, you can have one chart for tracking your overall savings, another for specific holiday expenses like gifts or travel, and even one for each family member to set individual savings goals. This customization enables you to tailor your financial planning to your unique needs and circumstances.

Having a Christmas savings tracker also serves as a constant reminder to be mindful of your spending during the holiday season. It’s easy to get caught up in the festive spirit and overspend, but with a tracker in place, you have a visual representation of your financial goals right in front of you. It encourages you to make conscious choices, prioritize your expenses, and keep unnecessary spending in check.

Overall, a Christmas savings tracker is a valuable tool for financial planning for Christmas. It offers a tangible way to track your progress, involves the whole family in a fun activity, and serves as a reminder to be mindful of your spending. Utilizing a DIY Money Saving Chart and Printable Budget Worksheet allows you to customize your savings journey and achieve a stress-free holiday season while staying financially responsible.

Tips for Successful Holiday Budgeting

To make the most of your Christmas savings, it’s important to practice effective holiday budgeting. By implementing these frugal Christmas tips, you can ensure that your holiday season is financially stress-free.

1. Start early and create a comprehensive budget: Begin your holiday preparations well in advance by creating a budget that includes all your anticipated expenses, such as gifts, food, and decorations. Having a clear plan from the outset will help you stay on track and avoid overspending.

2. Look for ways to save money: Embrace the spirit of the season by finding creative ways to save money. Consider making DIY gifts or opting for inexpensive but meaningful experiences instead of extravagant presents. This not only reduces your expenses but also adds a personal touch to your gifts.

3. Stay disciplined and avoid impulse purchases: It’s easy to get caught up in the excitement of holiday shopping and make impulsive purchases. However, staying disciplined and sticking to your budget is key to successful holiday budgeting. Before making a purchase, ask yourself if it aligns with your financial goals and if it’s truly necessary.

4. Use the Christmas savings tracker as a guide: The Christmas savings tracker is a powerful tool that helps you stay accountable and visualize your progress towards your savings goals. Make it a habit to update the tracker regularly and celebrate each milestone achieved.

“Holiday budgeting requires discipline and careful planning. By setting realistic goals and sticking to your budget, you can enjoy the festive season without the stress of overspending.”

Frugal Christmas Tips

- Create a homemade holiday decorations

- Plan potluck-style gatherings to share the cost of food

- Shop for gifts during sales and utilize coupons

- Make use of free holiday events and activities in your community

- Consider regifting or repurposing items instead of buying new

By following these tips, you can have a joyful holiday season while staying on budget. Remember, the true spirit of the holidays lies in creating meaningful experiences and cherished memories, not in excessive spending.

| Expense Category | Budget | Actual Spending |

|---|---|---|

| Gifts | $200 | $175 |

| Food | $100 | $90 |

| Decorations | $50 | $40 |

| Entertainment | $75 | $70 |

Remember, budgeting for the holidays is all about finding a balance between enjoying the festive season and managing your finances responsibly. With careful planning and adherence to your budget, you can have a wonderful holiday without breaking the bank.

Other Christmas Savings Challenge Options

In addition to the Christmas Money Saving Chart, there are other options available to help you save for the holidays. Savings tracker templates, budget binders, and free planner printables can all assist in organizing your finances and monitoring your progress. Experiment with different methods to find what works best for you in terms of motivation and convenience. Remember, the key is to find a system that keeps you engaged and committed to your savings goals.

1. Savings Tracker Template

Savings tracker templates are a great way to visually track your progress towards your savings goal. These templates allow you to input your target amount and track your savings on a regular basis. Whether you choose a printable template or a digital spreadsheet, a savings tracker template provides a clear overview of your progress and motivates you to stay on track.

2. Budget Binder

A budget binder is a comprehensive tool that helps you organize your finances and monitor your savings. It typically includes various sections such as budget worksheets, expense trackers, and savings goals. By keeping everything in one place, a budget binder allows you to easily track your progress and make adjustments as needed. Additionally, it provides a structured approach to managing your expenses and keeping your savings on track.

3. Planner Free

A free planner is another option to consider for tracking your Christmas savings. Many online platforms offer free printable planner pages specifically designed for budgeting and financial planning. These planners typically include sections for goal setting, budget tracking, and expense monitoring. By utilizing a free planner, you can stay organized, set reminders, and stay motivated on your savings journey.

Remember, regardless of the option you choose, the key is to find a method that works best for you and keeps you motivated towards your savings goals. Whether it’s a savings tracker template, a budget binder, or a free planner, these tools are designed to help you stay on track and achieve your holiday savings goals.

You can also read: Top Budget Planner Books

Conclusion

Saving money during the holiday season is crucial for a stress-free and debt-free celebration. The Christmas Savings Chart is a valuable tool that can help individuals and families stay on track and achieve their financial goals. By involving the whole family and implementing frugal Christmas tips, it’s possible to maximize savings and reduce expenses.

When it comes to financial planning for Christmas, starting early and budgeting wisely are key. By creating a comprehensive budget that includes all anticipated expenses, such as gifts, food, and decorations, individuals can avoid overspending and stay within their means. The Christmas Savings Chart serves as a visual reminder of progress, keeping individuals accountable and motivated.

Moreover, it’s important to prioritize emergency fund saving during the holiday season. Setting aside funds for unexpected expenses can provide peace of mind and ensure financial stability. By incorporating emergency fund saving into the holiday budget, individuals can avoid unnecessary financial stress.

In summary, careful financial planning, utilizing tools like the Christmas Savings Chart, and prioritizing emergency fund saving are vital components of a successful holiday budget. By following these strategies, individuals can enjoy the festive season without the burden of excessive debt and financial strain.

FAQ

How do I use the Christmas Savings Tracker?

To use the Christmas Savings Tracker, decide on the amount you want to save per day, transfer that amount into a separate account or put the cash into an envelope, and color in the corresponding amount on the chart each time you save.

What are the benefits of using a Christmas Savings Tracker?

A Christmas Savings Tracker provides a visual representation of your savings progress, helps you stay motivated, involves the whole family in a fun activity, reminds you to be mindful of your spending, and encourages financial planning for Christmas.

What are some tips for successful holiday budgeting?

Some tips for successful holiday budgeting include starting early, creating a budget that includes all anticipated expenses, looking for ways to save money, staying disciplined and avoiding impulse purchases, and using the Christmas Savings Tracker to keep yourself accountable.

Are there other options available for saving money during the holidays?

Yes, there are other options available such as savings tracker templates, budget binders, and free planner printables that can help you organize your finances and monitor your progress.